Superannuation Fund (Younger Individuals)

Accelerating the Benefits of Your Superannuation Fund with Mintwell

Mintwell’s Super Fund

The Superannuation Fund option provided by our team at Mintwell offers a range of benefits to our clients, including lower fees, access to insurances, personalised investment options tailored to your risk profile, performance, and service. We prioritise you as individual rather than a number.

Fees

Most funds may impose a range of fees, including administration, investment, advice, switching and activity-based fees. At Mintwell, we charge a transparent, flat annual fee which is in our client FSG (financial services guide).

Insurance

Cover options such as Life, Disability, and Income-protection insurance are not offered by default, and all clients are given the opt-in and opt-out option and never automatically charged.

Investment options

Australian superannuation funds may offer different investment strategies. The right strategy depends on the level of risk versus reward that you’re comfortable with. For example, a conservative option might offer you low risk but low growth over the long term, while a growth investment option might expose you to higher risk but potentially higher returns.

Performance

How has the fund performed in the past? Mintwell is partnered with Hub24, Australia’s fastest growing Superannuation fund.

Mintwell Superannuation service offers support services that a lot of funds do not offer, including:

- Mobile App.

- Dedicated adviser with direct access.

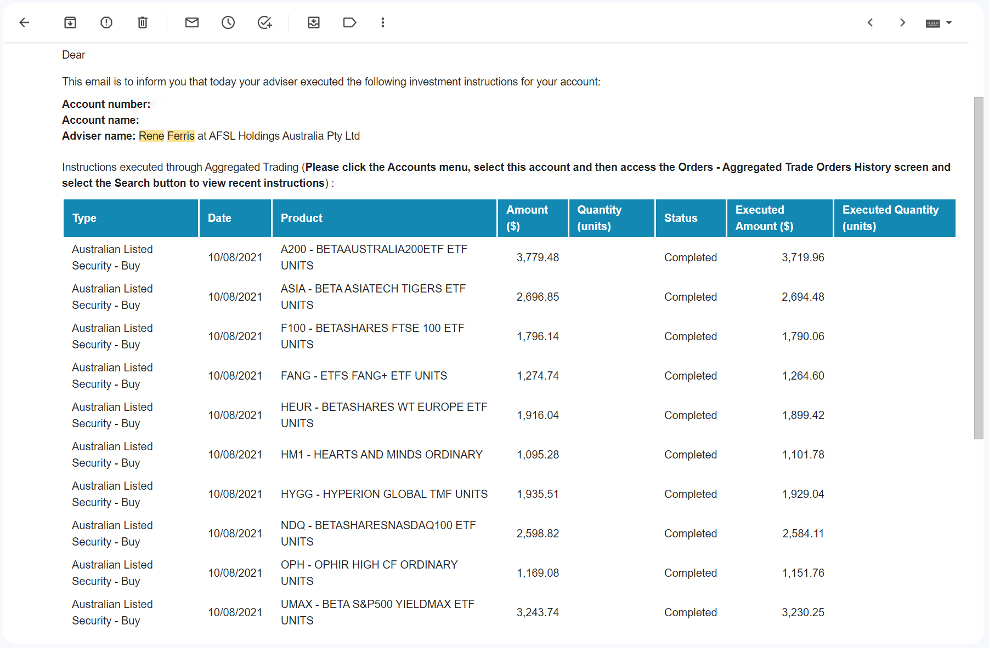

- Regular trade updates emailed to you, the client.

The Three Main Types of Superannuation Funds – Industry, Wrap & SMSF

Industry Super Fund

Industry super funds are profit-for-member organisations and are the general Super funds we see advertised in the public.

Wrap Platform

An investment platform designed to manage a range of different asset types. When you open a wrap account, your adviser can place all investments you buy and sell online. This becomes a single platform for all the different assets you hold. This type of Superannuation platform is only accessible via a Financial Adviser.

SMSF

Self-managed super funds (SMSFs) are a way of saving for your retirement. The difference between an SMSF and other types of funds is that the members of an SMSF are usually also the trustees. This means the members of the SMSF run it for their benefit and can choose to buy residential and commercial property, collectables and even physical commodities such as cars!

The First Home Super Saver Scheme

Mintwell’s Superannuation Service

Has Outperformed

Get notified whenever there is a trade

Our Clients are notified via email whenever a trade is made in their Super Fund which stays in-line with Mintwell’s client-transparency model.

Digital First Firm

Providing Clients Secure Access to Their Finances Anytime, Anywhere